Introduction

Filing your tax return through MyGov Tax Return can seem overwhelming, but it’s actually straightforward if you follow the right steps. In this guide, we will take you through the entire process, making sure you understand each step with ease. Whether you are a first-timer or need a refresher, this guide will help you.

What is a MyGov Tax Return?

The MyGov tax return is a digital way to submit your annual tax information to the Australian Taxation Office (ATO). The platform simplifies tax filing by bringing various services into one place, allowing you to manage your tax, Medicare, Centrelink, and other government services in one portal. By using MyGov, you save time and avoid paperwork.

Why Choose MyGov for Filing Tax Returns?

Using MyGov is an efficient and user-friendly way to manage your taxes. The platform allows easy access to government services, making tax filing more accessible. You can easily view your income details, pre-filled forms, and deductions. The MyGov tax return process ensures you don’t miss any key information, helping you avoid errors.

Here are a few reasons why MyGov stands out for tax filing:

Easy Access: Manage taxes, Medicare, and more from one platform.

Pre-filled Information: Your employer sends data directly to the ATO, which pre-fills your tax forms.

Error Minimization: MyGov checks your return for errors and prompts you before submission.

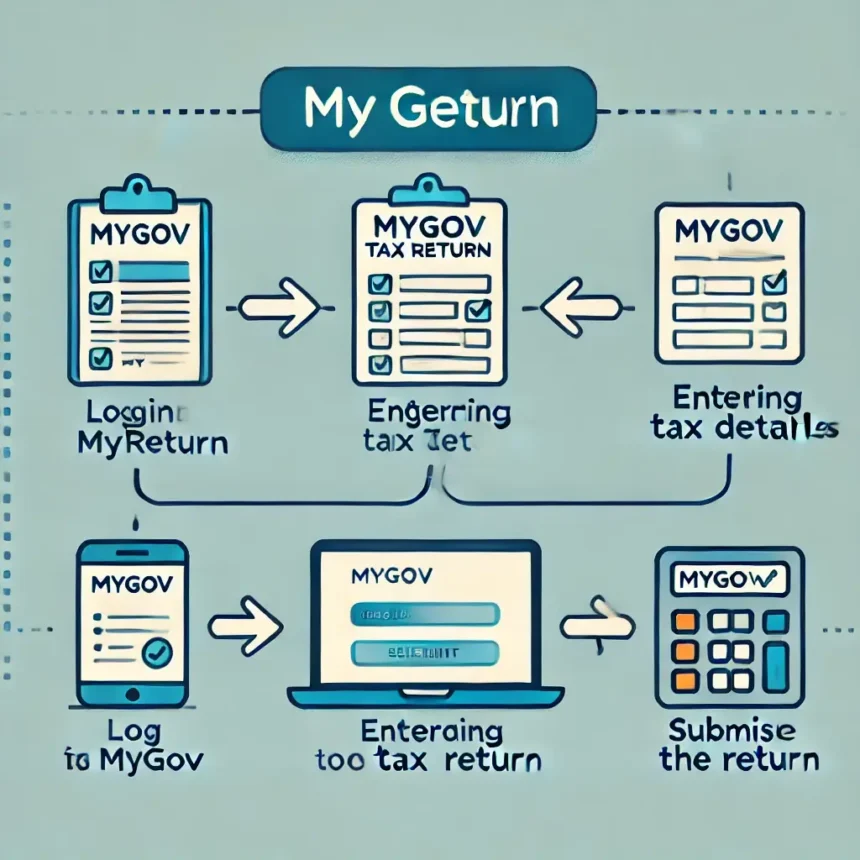

How to Lodge a MyGov Tax Return

Filing your MyGov tax returns can be done in a few simple steps. Make sure you have all the necessary documents, such as your income statements, deductions, and any other supporting documents.

1. Log In to Your MyGov Account

To begin, visit MyGov and log into your account. If you don’t have an account, you can easily create one by following the registration process on the website.

2. Link to the ATO

Once logged in, you need to link your MyGov account to the Australian Taxation Office (ATO). If you haven’t done this before, the system will guide you through the process, asking for your tax file number and other identification details.

3. Start Your Tax Return

After linking to the ATO, click on the “Lodge Return” button. The system will automatically pull in data from your employer, bank, and other relevant organizations. You can review the pre-filled data and make any necessary adjustments.

4. Enter Deductions and Offsets

Make sure to enter any deductions you’re entitled to. This includes work-related expenses, charitable donations, and other eligible offsets. Use the system’s built-in tools to ensure you’re claiming correctly.

5. Review and Submit

Before submitting your MyGov tax returns, review all the information carefully. The system will alert you to any potential errors or missing details. Once you’re satisfied, click “Submit,” and your tax return will be sent to the ATO.

Common Issues When Lodging a MyGov Tax Return

While filing through MyGov is mostly straightforward, there are some common challenges that users face. Here’s how to avoid them:

1. Forgotten Password

Many users forget their MyGov login details. To resolve this, use the “Forgot Password” feature and reset it via your registered email address. Ensure your password is strong and stored safely.

2. Link Error with ATO

Sometimes, your MyGov account may not link properly to the ATO. This could be due to outdated information in your account or incorrect tax file number. Check your details carefully or contact the ATO for help.

3. Missing Documents

Pre-filled forms usually pull data automatically, but there could be missing documents, like payment summaries or deductions. Always double-check your details before submitting.

Benefits of Filing a MyGov Tax Return Early

There are several advantages to filing your MyGov tax returns as soon as possible:

Quick Refund: If you are entitled to a refund, lodging early will speed up the process.

Avoid Penalties: Late filing could result in fines or penalties from the ATO.

Peace of Mind: By completing your tax return early, you avoid the stress of last-minute filing.

Can I Correct My MyGov Tax Return After Filing?

Yes, you can amend your MyGov tax returns after submission. If you realize you’ve made an error or forgotten to include some information, simply log into MyGov, navigate to the ATO section, and request an amendment. Be sure to keep all supporting documents for any changes you make.

Is MyGov Secure for Tax Returns?

Security is a top priority for MyGov. The platform uses multi-factor authentication, secure encryption, and regular monitoring to protect your personal information. However, it’s crucial that you keep your login details private and secure, and avoid using public networks when filing your taxes.

What to Do After Filing Your MyGov Tax Return

Once you’ve successfully submitted your MyGov tax returns, there are a few more steps you should take:

Keep Records: Ensure you save a copy of your tax return and any related documents for future reference.

Monitor Refunds: If you are expecting a refund, monitor your bank account or check MyGov for status updates.

Plan for Next Year: Keep track of deductions and relevant documents throughout the year so next year’s filing is even easier.

FAQs About MyGov Tax Return

1. How Long Does It Take to Get a Tax Refund Through MyGov?

Typically, it takes 7-14 days to process a tax refund once you’ve lodged your MyGov tax return. However, the timeframe may vary depending on the complexity of your return.

2. Can I Lodge a MyGov Tax Return on a Mobile Device?

Yes, you can file your tax return using the MyGov mobile-friendly website. Simply follow the same steps as you would on a desktop.

3. What Should I Do If I Made a Mistake in My Tax Return?

You can correct errors by requesting an amendment through the MyGov portal. Log in, navigate to your return, and follow the steps to amend.

4. Is MyGov Secure for Filing Tax Returns?

Yes, MyGov is secure and uses encryption to protect your data. Always ensure you log out after completing your return and avoid public Wi-Fi for security reasons.

5. Can I File My Tax Return Using MyGov if I’m Self-Employed?

Yes, self-employed individuals can file their MyGov tax return using the platform. Be sure to have all relevant income and deduction information available.

Conclusion

Filing your MyGov tax returns is a quick and efficient way to meet your tax obligations. The platform offers a seamless experience, providing pre-filled forms and secure submission. By following the steps outlined in this guide, you can confidently lodge your tax return and enjoy the benefits of early filing.